Rates, Yields & Inflation: What’s Driving Real Estate This Week - Sep 12, 2025

Markets are always shifting, and it can be tough to know what that means for you as a buyer or seller. Here’s a quick look at this week’s biggest updates to help you stay ahead.

August CPI shows modest inflation uptick, with shelter driving gains

Inflation rose more than expected in August, largely due to higher housing costs, keeping the Fed cautious ahead of next week’s meeting.

Shelter costs (rent, owners’ equivalent rent, lodging) rose 0.4% in August, the largest contributor to the monthly headline increase

Real estate impact: Rising shelter inflation may push up operating costs and homeownership expenses (rent, housing services), limiting the space for rate cuts and potentially keeping mortgage rates higher for longer, which can dampen buyer demand.

10-Year Treasury yields dip near 2025 lows, helping long-term borrowing

Treasury yields fell this week, driven by mixed data, easing pressure on long-term rates and giving hope to real estate-related financing.

The 10-year Treasury yield briefly dropped to around 4.01%, before recovering slightly to about 4.064%.

Lower yields follow weak economic signals, especially in inflation and job data, boosting expectations of Fed rate cuts.

Real estate impact: Reduced long-term yields can lead to lower mortgage rates, easing financing costs for buyers, developers, and investors.

Container freight rates keep falling, trucking shows signs of soft demand

Global container shipping costs are down again, and U.S. trucking rates are easing under weak demand and excess capacity.

The Drewry World Container Index (WCI) dropped 3% this week to $2,044 per 40-ft container, marking its 13th straight week of decline.

U.S. truckload / spot trucking demand is soft, with rate pressure from oversupply and weaker freight volumes.

Real estate impact: With freight and shipping costs easing, material & supply chain expenses for development may drop, which can help reduce costs and support margins on new construction or rehab projects.

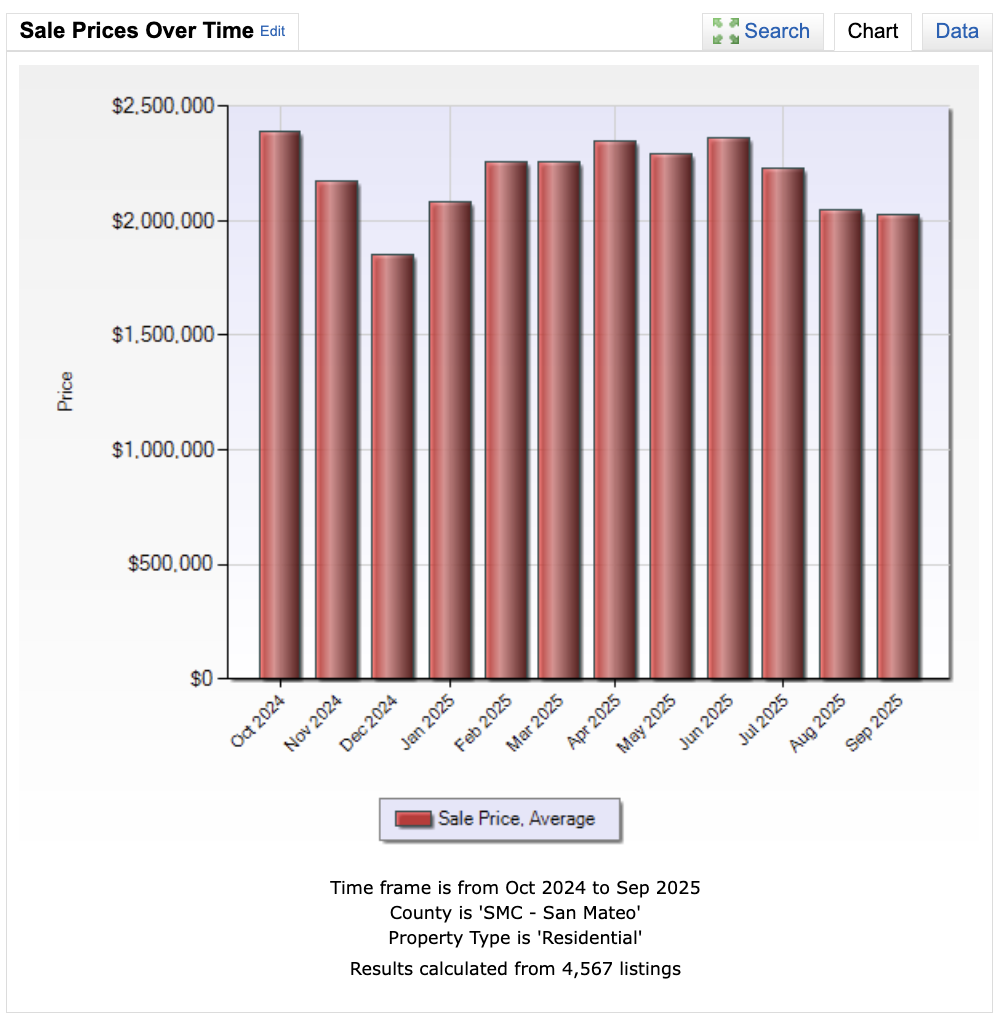

San Mateo County’s single-family home prices remained fairly stable over the past year, averaging between $2M–$2.4M. While there was a slight dip in December 2024, pricing rebounded strongly in early 2025 before gradually tapering off through the summer.

San Francisco’s average home prices saw a notable rebound in spring 2025 after softer pricing in the winter months, peaking in May before gradually tapering off over summer. While prices remained elevated year-over-year, monthly fluctuations show some seasonal softening heading into fall.

If you’d ever like to talk about what these trends mean for your own property goals, I’d be happy to connect.