November ‘25 Market Update

Rising Rates, Missing Data, and What It Means for Housing

As the economy shifts, so does the housing market. Here’s a quick look at what’s driving today’s trends — and what it could mean for your next move.

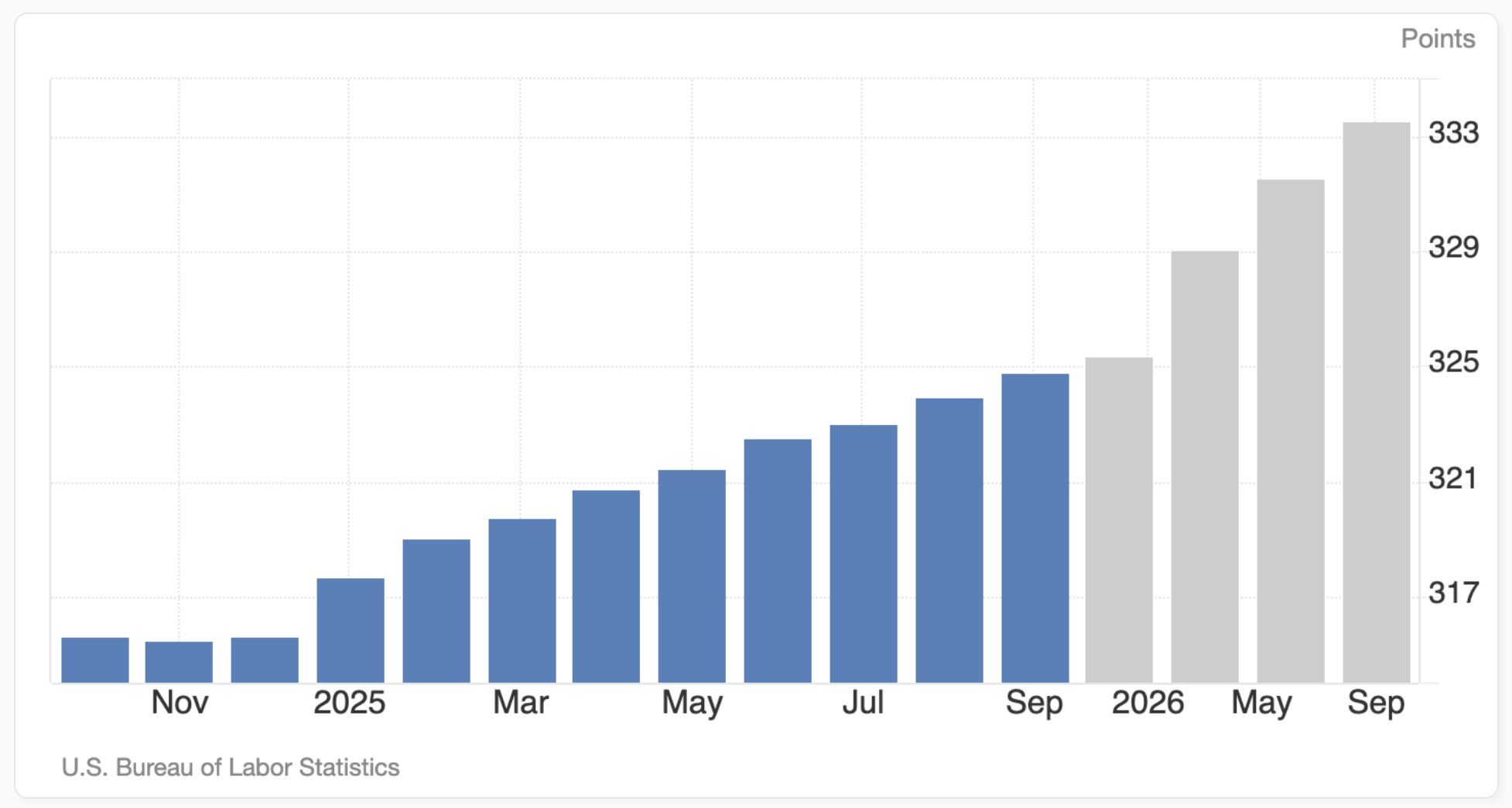

Government Shutdown Freezes October CPI and Jobs Data, Reports May Never Be Released

The shutdown has stopped October CPI and jobs reporting, with officials saying the figures may never be produced, leaving inflation and labor trends unclear.

Economists expect a 0.3% hit to Q4 GDP as confidence weakens and markets lose key guidance.

Missing data supports a “higher for longer” rate outlook, keeping mortgage rates near 6.24% and applications down 4% WoW; a resolution could unlock pent-up buyers.

30-Year Mortgage Rates Edge Up to 6.24%, Halting Recent Decline

The 30-year fixed rate rose to 6.24%, its second weekly increase, while 15-year rates slipped to 5.49% amid higher Treasury yields and inflation concerns.

Purchase applications rose 1% WoW but stay 10% below last year, showing buyers are still cautious.

The uptick adds about $40/month to a median-priced home, tightening affordability; with 3.8 months of inventory, price growth may hold near 2–3% y/y, while refis stay muted and cash buyers gain advantage.

Fed Signals Hawkish Tilt, Dampening Hopes for December Rate Cut

Fed officials reinforced a “higher for longer” stance, pushing December cut expectations down to 55%, from 70% last week.

With limited new data, attention turns to November releases after September’s move to 3.75%–4.00%.

Lower odds of near-term cuts mean sub-6% mortgages remain unlikely, keeping turnover slow and potentially trimming Q4 housing starts by ~2%, while sustained borrowing costs pressure builders.

Homes in San Mateo County sold between 105–108% of list price with average days on market ranging from 15–30 days, indicating steady buyer demand and a competitive pace throughout 2025.

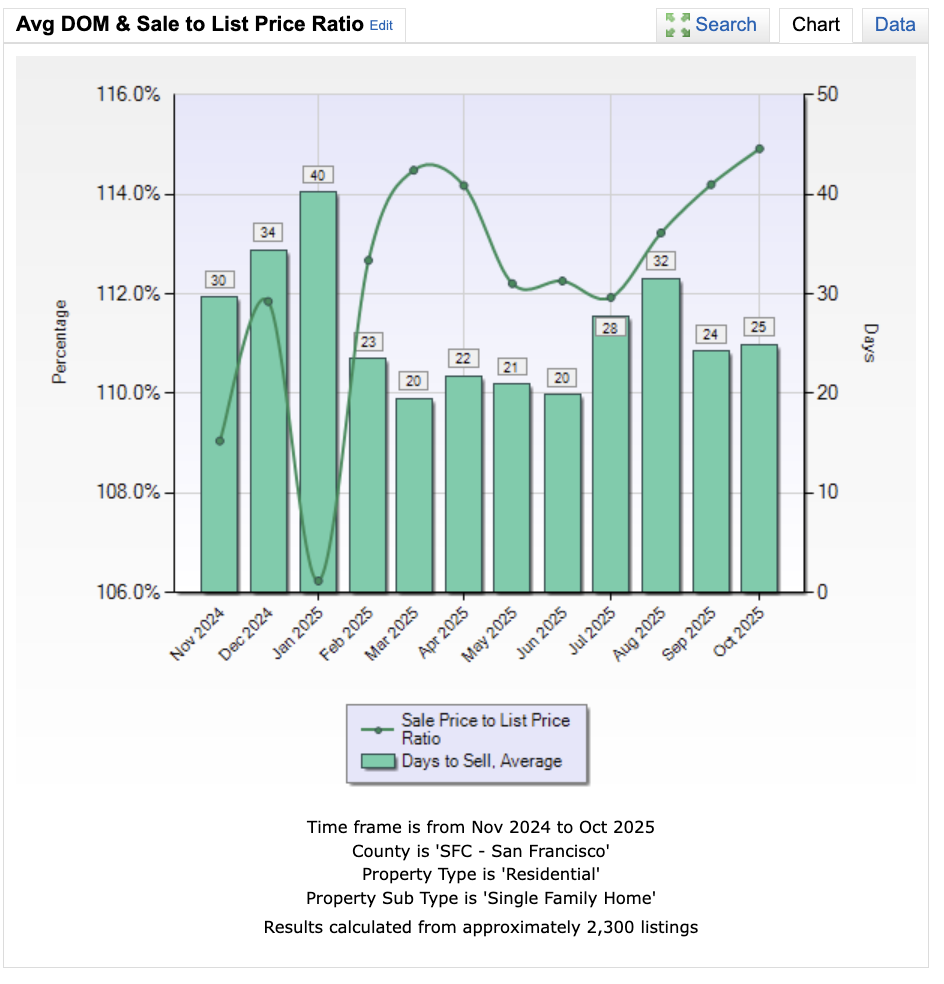

In San Francisco, single-family homes consistently sold well above list price at 110–115%, with days on market ranging from about 20–40 days, reflecting strong buyer competition and a brisk, resilient market through 2025.

Hope you found this market update useful! Whether you’re considering a move soon or just keeping tabs on your home’s value, I’m here anytime you’d like to talk through next steps.